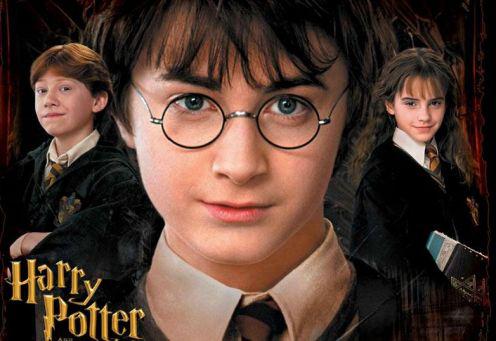

Harry Potter And The Chamber Of Secrets Nl Subs Spectre

- Posted in:Admin

- 07/04/18

- 21

In economics, physical capital or just capital is a factor of production (or input into the process of production), consisting of machinery, buildings, computers, and the like. The production function takes the general form Y=f(K, L), where Y is the amount of output produced, K is the amount of capital stock used and L is the amount of labor used. In economic theory, physical capital is one of the three primary factors of production, also known as inputs in the production function. The others are natural resources (including land), and labor — the stock of competences embodied in the labor force. 'Physical' is used to distinguish physical capital from human capital (a result of investment in the human agent)), circulating capital, and financial capital.[1][2] 'Physical capital' is fixed capital, any kind of real physical asset that is not used up in the production of a product. Country Leisure Hot Tub Manual. Usually the value of land is not included in physical capital as it is not a reproducible product of human activity.

Built with Typeform, the FREE online form builder that lets you create beautiful, mobile-friendly online forms, surveys & much more. Try it out now! Feel free to ask for your 6 hours test account for mag250/254, smarttv, vlc, enigma2 and other avialable devices You may contact us instantly in chatbox. Index of /Subs/Movies. Parent Directory. WEB-DL.x264-RARBG-eng.srt Ant.Man.2015.720p.WEBRip.x264.AAC-ETRG.srt Ant.Man.2015. Potter.and.the-deathly-hallows-part-2-2011.srt Harry.Potter.and.the.Chamber.of.Secrets.2002.1080p.BrRip.x264.YIFY.srt Harry.Potter.and.the.Half.Blood.Prince.2009.1080p.

In finance, a foreign exchange option (commonly shortened to just FX option or currency option) is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date.[1] See Foreign exchange derivative. The foreign exchange options market is the deepest, largest and most liquid market for options of any kind. Most trading is over the counter (OTC) and is lightly regulated, but a fraction is traded on exchanges like the International Securities Exchange, Philadelphia Stock Exchange, or the Chicago Mercantile Exchange for options on futures contracts. The global market for exchange-traded currency options was notionally valued by the Bank for International Settlements at $158.3 trillion in 2005 For example, a GBPUSD contract could give the owner the right to sell?1,000,000 and buy $2,000,000 on December 31. In this case the pre-agreed exchange rate, or strike price, is 2.0000 USD per GBP (or GBP/USD 2.00 as it is typically quoted) and the notional amounts (notionals) are?1,000,000 and $2,000,000. This type of contract is both a call on dollars and a put on sterling, and is typically called a GBPUSD put, as it is a put on the exchange rate; although it could equally be called a USDGBP call.

If the rate is lower than 2.0000 on December 31 (say 1.9000), meaning that the dollar is stronger and the pound is weaker, then the option is exercised, allowing the owner to sell GBP at 2.0000 and immediately buy it back in the spot market at 1.9000, making a profit of (2.0000 GBPUSD? 1.9000 GBPUSD)? 1,000,000 GBP = 100,000 USD in the process. If instead they take the profit in GBP (by selling the USD on the spot market) this amounts to 100,000 / 1.9000 = 52,632 GBP. Although FX options are more widely used today than ever before, few multinationals act as if they truly understand when and why these instruments can add to shareholder value. To the contrary, much of the time corporates seem to use FX options to paper over accounting problems, or to disguise the true cost of speculative positioning, or sometimes to solve internal control problems. The standard clich?

About currency options affirms without elaboration their power to provide a company with upside potential while limiting the downside risk. Options are typically portrayed as a form of financial insurance, no less useful than property and casualty insurance. This glossy rationale masks the reality: if it is insurance then a currency option is akin to buying theft insurance to protect against flood risk. The truth is that the range of truly non-speculative uses for currency options, arising from the normal operations of a company, is quite small. In reality currency options do provide excellent vehicles for corporates' speculative positioning in the guise of hedging. Corporates would go better if they didn't believe the disguise was real. Let's start with six of the most common myths about the benefits of FX options to the international corporation -- myths that damage shareholder values.

Historically, the currency derivative pricing literature and the macroeconomics literature on FX determination have progressed separately. In this Chapter I argue the joint study of these two strands of literature and give an overview of FX option pricing concepts and terminology crucial for this interdisciplinary study. I also explain the three sources of information about market expectations and perception of risk that can be extracted from FX option prices and review empirical methods for extracting option-implied densities of future exchange rates. As an illustration, I conclude the Chapter by investigating time series dynamics of option-implied measures of FX risk vis-a-vis market events and US government policy actions during the period January 2007 to December 2008. Chapter 2: This Chapter proposes using foreign exchange (FX) options with different strike prices and maturities to capture both FX expectations and risks. We show that exchange rate movements, which are notoriously difficult to model empirically, are well-explained by the term structures of forward premia and options-based measures of FX expectations and risk.